MGID Advertiser verification program

This article will review the MGID Advertiser verification program, which includes KYC and KYB processes.

- About Verification

- KYC: verification through iDenfy

- KYB process

- Request for re-verification, suspending the Advertiser’s access, or blocking accounts

- Advertisers TOS, Insertion Order(s)

1. About Verification

Most Advertising Platforms have already been required to proceed with the ID Verification of their users in today's dynamic digital environment.

MGID follows the Advertiser verification procedure to enable the Company to comply with legal regulations. It includes the steps that advertisers will be required to follow and complete.

Our team pays special attention to implementing Know Your Client (KYC/KYB) procedures and ensures the operation of an effective system for tracking suspicious transactions and suspicious activities.

MGID Group is responsible for preventing fraud and financial crimes throughout the Advertiser Platform. We establish, maintain and reassert trust from account registration through the entire client lifecycle.

To maintain accurate and up-to-date records, MGID conducts due diligence checks on new and existing clients and ongoing monitoring of client activities on a risk-based approach:

- Verify the user’s identity

- Check their ID and supporting documentation

- Authenticate them

- Perform ongoing screening to ensure they’re not on watchlists, monitor activities, manage investigations and report suspicious activity (block users if needed).

Only verified users will be able to proceed with business cooperation.

2. KYC (Know Your Customer): Verification through iDenfy

According to the MGID Verification Program, advertisers-individuals must proceed with the ID verification through iDenfy.

Benefits of verification through iDenfy:

- Automatic ID document detection recognizes documents by type and country: Recognizing, verifying and extracting information from identity documents across 190+ countries.

- ID verification with biometric and liveness. Advanced biometric and face recognition algorithms ensure that the faces analyzed are real and prevent the use of pictures of faces, 3D masks, and other fakes or renderings in the identity verification process.

Only approved users will have access to the MGID dashboard.

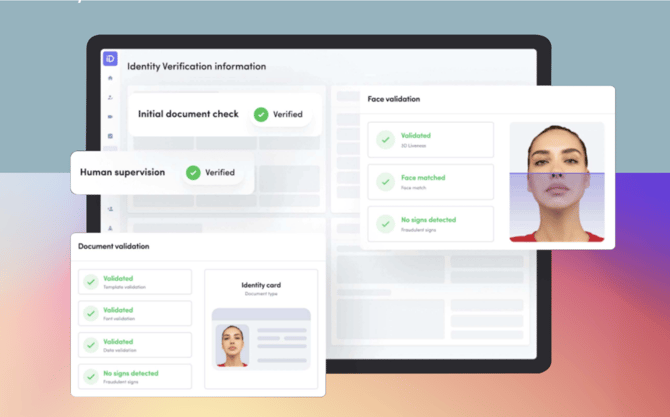

*Image 1 - Identify Verification information

3. KYB (Know Your Business) Process

KYB process stages:

- Request to fill out and provide the company’s documents

- Collecting and Analyzing the company’s data

- Conclusions and Risk Assessment

In case an advertiser is a legal entity and has one or more MGID accounts, we apply the KYB approach by collecting and analyzing the company's data. KYB checks help to verify the legal existence of a business and assess the risks associated with the company, its industry, and its country of origin.

During the KYB procedure, Advertisers will be asked to:

- Fill out and sign the KYB onboarding form

- Provide the company’s documents: Certificate of Incorporation/Registration and Certificate of Good Standing or Extract from Commercial Register (should not be older than 3 months)

In addition, please note that an advertiser will be asked to provide additional information if the business activities belong to the high-risk category, such as gambling, batting, pharma, etc.

Only verified users will have access to the MGID dashboard.

4. Request for re-verification, suspending the Advertiser’s access, or blocking accounts

- If some of the documents are outdated or expired;

- If previous verification does not meet the requirements for the new Anti-Money Laundering standards;

- If the Advertiser violates any of the provisions of the TOS or any provisions contained in any and all Insertion Order(s);

- If an advertiser is engaged in “cloaking” techniques, etc.

If some of the above-mentioned conditions are met, business-related information and documents (e.g., active license) will be required.

MGID team prioritizes security and does its best to prevent aforecited violations from running through active advertising.

Here are a few of the most common violation cases, including but not limited to:

- Malware File

- Malicious URL

- Phishing

- Browser Locking

- Pre-Click File Download

- Browser locking

- Cloaking, deceptive, inappropriate content, fake news, scam, etc.

5. Advertisers TOS, Insertion Order(s)

During the registration process, each user/advertiser must accept the MGID Terms of Service.

By accepting MGID’s Terms of Service, Advertiser has the right to use the Services and is bound by the present Terms of Service. Advertiser is the sole responsible for the accuracy of the Ads' Data and any Ads' Content or other data provided by Advertiser.

Signed Insertion Order(s) constitutes a binding agreement between the Advertiser identified in the Insertion Order and the Advertising Platform.

In case an Insertion Order requires additional information, the Advertiser will be asked to provide it.

Please note that we endeavor to protect clients' personal data while it is processed, stored, or transferred.

FAQ

1. Why is Identity Verification Important for MGID Ads Platform?

In order to comply with KYC (Know Your Customer) and Anti-Money Laundering regulations and increase your account security, MGID requires all clients to complete Identity Verification.

2. What is MGID Ads verification?

Advertiser verification is a procedure that includes personal ID verification and business verification of the MGID platform users.

- If you are an individual advertiser, you will be required to proceed with the ID verification through iDenfy.

- Business entities will be asked to fill out the KYB form and provide company documents.

3. What is Online Identity Verification?

The company behind Online ID verification is iDenfy.

iDenfy is global digital identity verification and fraud prevention platform helping organizations comply with the ever-evolving Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

- iDenfy will check data authentication of one’s identity document, such as a passport, national identity card, driving license, or resident permit.

- The face of a verifying person should be determined by providing a real live selfie. The photo should be taken in real-time, and a face from the document should be matched with the selfie face.

4. How to complete Online ID Verification successfully

- Watch the video instructions here.

- Verification tips

- Time Frames - you will have 30 minutes to complete the verification process before the session closes. Just have your ID document ready so that you can show it immediately;

- Good Lighting Area;

- Use a Good Camera and Internet;

- Select the correct ID document type (before starting);

- Take Sharp Photos - please note that ID documents and residence permits have essential information on both sides. So, kindly capture both of them;

- Proof of Identity - please use a valid passport, ID card, driving license, or residence permit. The image should not have any explicit erasures, falsifications, crossed words, other unspecified corrections, or traces of graphic editing;

- Identity documents must not have a cover;

- Please proceed through Verification On Your Own

In case you fail the verification process, you will have the opportunity to start from the beginning.

5. Is data secure?

Identity Verification software with all the included features fully complies with GDPR, CCPA, and other latest data protection laws.

Data at all times is encrypted and safe. iDenfy is ISO27001:2013-certified company.

6. Is it possible to use the MGID Platform without verification?

You can register and create the campaign, but to move forward, you will be asked to proceed with the verification procedure.

Due to our company policy, the ID Verification procedure is a mandatory request.

Please note that only verified users will be able to replenish the balance.

Video Guide